Florence Lo/Illustration/Reuters

- Chinese crypto addresses have sent $2.2 billion worth of digital assets to illicit activities.

- But transactions have since fallen due to the absence of large-scale schemes such as the PlusToken scam in 2019.

- The study, conducted between April 2019 and June 2021, was published by Chainalysis on Tuesday.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

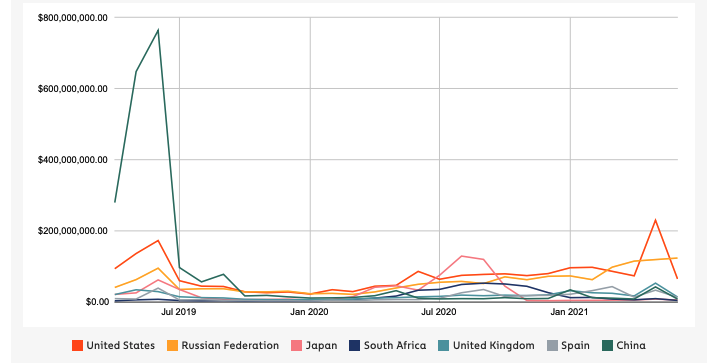

Chinese cryptocurrency addresses sent $2.2 billion worth of digital assets to addresses associated with illicit activities between April 2019 and June 2021, according to a study by cryptocurrency software firm Chainalysis released on Tuesday.

While high, that amount is down significantly from previous timeframes due in large part to the absence of big Ponzi schemes such as the PlusToken scam in 2019, in which Chinese services were used to launder proceeds, the study said. Users lost roughly $3 billion-$4 billion in that scam.

"Money laundering is another notable form of cryptocurrency-based crime disproportionately carried out in China and has become of particular concern to the US in cases where it intersects with sanctions evasion," Chainalysis said.

The study pointed to an instance in March 2020, when two Chinese nationals were charged by the US Justice Department with laundering over $100 million in cryptocurrency to help North Korean syndicates.

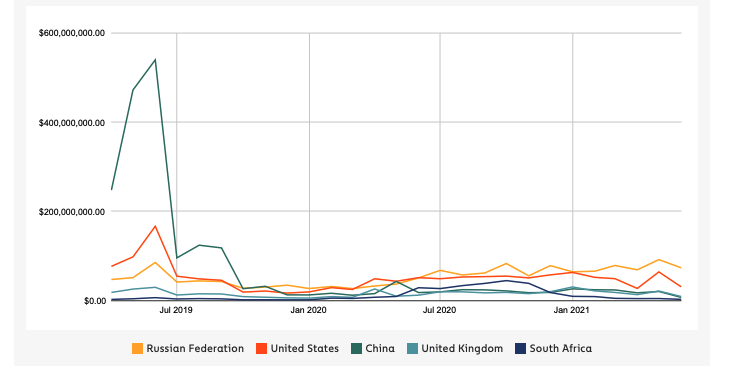

But by 2020, the US and Russia surpassed China in terms of cryptocurrency-related crimes, widening the gap further in 2021.

Chainalysis

Chinese cryptocurrency addresses received over $2 billion from darknet market operations in the time period studied, but activity began cooling in 2020 for scams in China and picked up for scams targeting Russia and the US.

China's slowdown could also be attributed to the nation's increasingly tough stance toward the crypto market in recent years.

In June 2021, authorities arrested over 1,100 individuals suspected of cryptocurrency-based money laundering, the study added.

"It will be interesting to see whether the arrests lead to a drop in flows of illicit funds to China-based cryptocurrency businesses and OTC traders," Chainalysis said.

Chainalysis

Recently, China's status as the top cryptocurrency mining country has been diminished as regulators tightened their grip on the sector. China had accounted for over 65% of activity before the crackdown, data from the Cambridge Centre for Alternative Finance showed.

Bitcoin's hashrate, a key measure of the health of the bitcoin network, has since dropped by more than 50%.